Are taxes applied to lottery prizes in Spain? How much money do I have to pay to the State to win the first prize of the Christmas lottery?

The answer is yes, the Christmas Lottery prizes in Spain are subject to tax, but only from a certain amount. In this article you can read all the information about it.

This year, the Christmas Lottery draw will distribute 2,408 million euros in prizes. The winners of the first prize, dubbed El Gordo de Navidad, will receive 400,000 euros for each 20-euro winning ticket.

The second prize is 125,000 euros per ticket and the third prize 50,000 euros per ticket.

In addition, there are two fourth prizes of 20,000 euros per ticket and eight fifth prizes of 6,000 euros per ticket, as well as 1,794 prizes of 100 euros.

The taxes

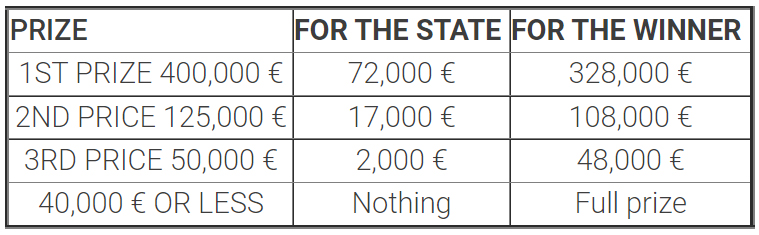

Regarding tax levies, the regulations in Spain establish that the prizes of less than or equal to 40,000 euros will not be subject to the special tax on lottery prizes. This means that, if we win a higher prize, we will have to subtract 40,000 euros from the total amount of the prize, which will in any case be exempt from taxes.

The rest of the amount of the prize (from 40,000 euros), is subject to a tax of 20% by the Treasury. Therefore, if we win El Gordo de Navidad (400,000 euros), we will enjoy 40,000 euros exempt from taxes. But of the remaining 360,000 euros, the Treasury will take 20% (72,000 euros).

In addition to the money collected through this special tax, the Spanish State also keeps a part of the money from the sales of the lottery tickets.

According to the Spanish lottery operator (Loterias y Apuestas del Estado), 70% of the money raised goes to prizes and 30% remains with the Treasury.