If you live in Finland and you are a beneficiary of an unemployment benefit, you can work part-time. However, the income you get from these jobs can affect the amount of the subsidy paid by the state.

According to the information published by Kela, "when you find part-time or incidental work your unemployment benefit is adjusted to your earnings and you will receive an adjusted unemployment benefit". This means that the amount of your subsidy may be reduced according to the earnings you get from your work.

The exempt amount

The first thing you need to know is that there is an exempt amount of earnings of 300 euros (before taxes). You can earn up to that per month without suffering a reduction in your unemployment benefit. More specifically, the exempt amount is 300 euros if the adjustment period is one month and 279 euros when it is four weeks.

In case you exceed those amounts, the principle applied is that benefits must be adjusted to wages, as explains the Finnish Social Security Institution (Kela) on its website. And the basic rule is that each euro of earned income above the exempt amount decreases the unemployment benefit by 50 cents. Included in earned income are such payments as wages and other monetary compensations, taxable reimbursements of expenses, fringe benefits, etc.

In Finland you may work and still get an adjusted unemployment benefit if you meet any of the following conditions:

- You earn income from a temporary full-time job that lasts for a maximum of 2 weeks.

- You earn income from a part-time job, and your working hours based on which you are paid are no more than 80 percent of the full-time hours applicable in that sector.

- You continue working but your daily working hours are shortened due to temporary lay-off.

- You have income from self-employment as a secondary business.

- Your full-time self-employment activity lasts for a maximum of two weeks.

- You start a business while unemployed. In that case you will be paid an adjusted unemployment benefit for the first four months of running the business.

The new payment rules

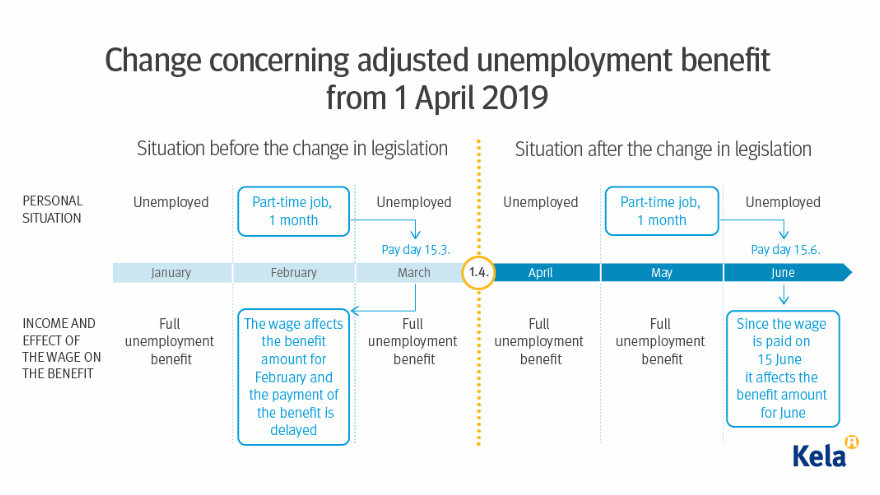

The rules concerning the payment of adjusted unemployment benefits have changed since 1 April 2019.

And under the revised rules, the salary for work that was undertaken before 1 April 2019 will still be adjusted in accordance with the period that it was earned. This is how it was done before the legal reform, but this caused many annoyance to the unemployed, who had to wait for the payment and after for the Social Security to make the adjustment before receiving their subsidies.

Source: Kela

But since 1 April 2019, an unemployment benefit is adjusted to the salary in the same benefit payment period in which the salary is paid. In practice this means that, for example, if someone works part time in May but is paid in mid-June, the unemployment benefit is adjusted to the salary paid for the month of June. "This way benefit payments are no longer delayed by salaries that are paid in arrears", says Kela.

The benefit is paid every four weeks. This is called the adjustment period. But the unemployment benefit can also be paid per calendar month if you have a part-time job where the wage is paid once a month.

What part-time employees and entrepreneurs must do

What you should do if you find yourself in that situation is to report the number of hours and the number of days that you have worked to Kela in your unemployment status report.

If you are someone's employee, since 1 January 2019 Kela obtains your salary information from the national incomes register, but income from self-employment must always be reported too.

The Finnish regulations allow you to start a business while unemployed and you can still continue to receive unemployment benefit payments for 4 months. But this unemployment benefit will be affected by your self-employment income, which means that the income from self-employment reduces the unemployment benefit.