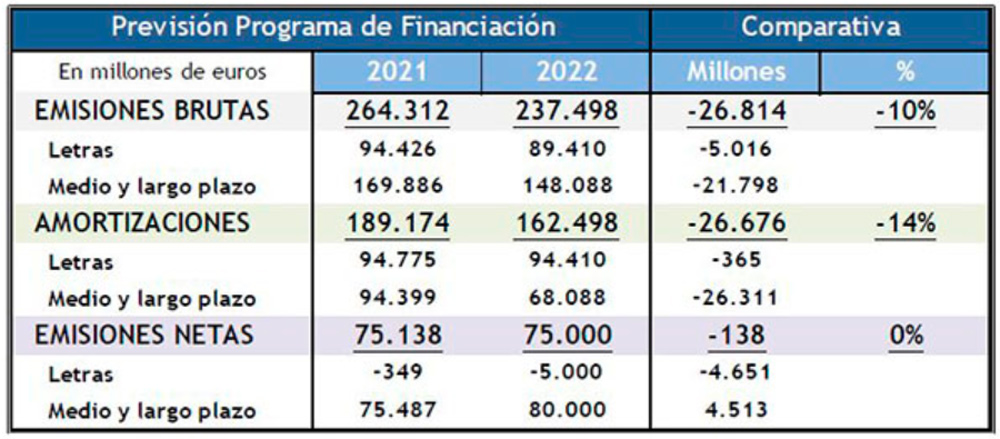

The Spanish Public Treasury has presented its financing strategy for 2022. The expected net issuance is 75 billion euros, the same as at the end of 2021, but the gross issuance is reduced to 237,49 billion euros (-10%) due to the lower volume of redemptions.

The government says the financing program for 2022 starts from a prudent scenario.

Spanish financing strategy 2022. Source: Ministry of Economic Affairs.

Spanish financing strategy 2022. Source: Ministry of Economic Affairs.

To the usual financing instruments will be added the funds from the Next Generation EU Recovery Fund. Specifically, the state budget for next year foresees income of 20.22 billion euros from this instrument.

In 2022 the repayment of the loan of the European Stability Mechanism (ESM) agreed in 2012 for the recapitalization of the financial system begins. Of the initial 41,333 million euros, Spain has already prepaid 17,612 million. The remaining 23,721 million is expected to be amortized in six annual disbursements between 2022 and 2027.

In 2022 the Treasury intends to accelerate the issuance of debt in the first half of the year. The effort to extend the average maturity of the issued debt will also continue.

End of 2021

According to government information, the Treasury during 2021 maintained its ability to finance in good conditions the additional spending derived from the response to COVID-19 in the health, economic and social sphere, both of the Central Administration and of the autonomous communities.

The favorable conditions of access to financial markets, together with the good evolution of tax revenues and the receipt of the advance and the first disbursement of funds from the Next Generation EU program, allowed the volume of financing raised in 2021 to be reduced by 25,000 million.

In this way, the Treasury completed its financing program last year with a net issuance of 75,138 million euros and a gross issuance of 264,312 million euros, 25% below the forecast at the beginning of the year.